I’m a terrible budgeter (although I do manage to save for the things I make a priority). I’m not so good week to week. I thought it was time to get sensible about money. After hearing some recommendations online, I’ve recently devoured “The Barefoot Investor” by Scott Pape and I am super keen to start. If you’re not all over your money and it freaks you out, then I highly recommend you read it. This post isn’t sponsored by the way, just a public service announcement. Pape knows about money. He’s an independent financial advisor and knows first hand what it is like to lose everything. He watched his farm and everything he owned burn down in the Victorian bushfires. But was able to turn to his wife at the time and say “I got this”, and he had. This is the essence of the Barefoot Investor Budget. Pape wants you to be prepared for all possible events, but wants you to have fun too. He asks that you schedule dates to see how you are tracking, and five consecutive ones to get things going. Here are the principles of a Barefoot Budget and how you should allocate your money. Let’s do it.

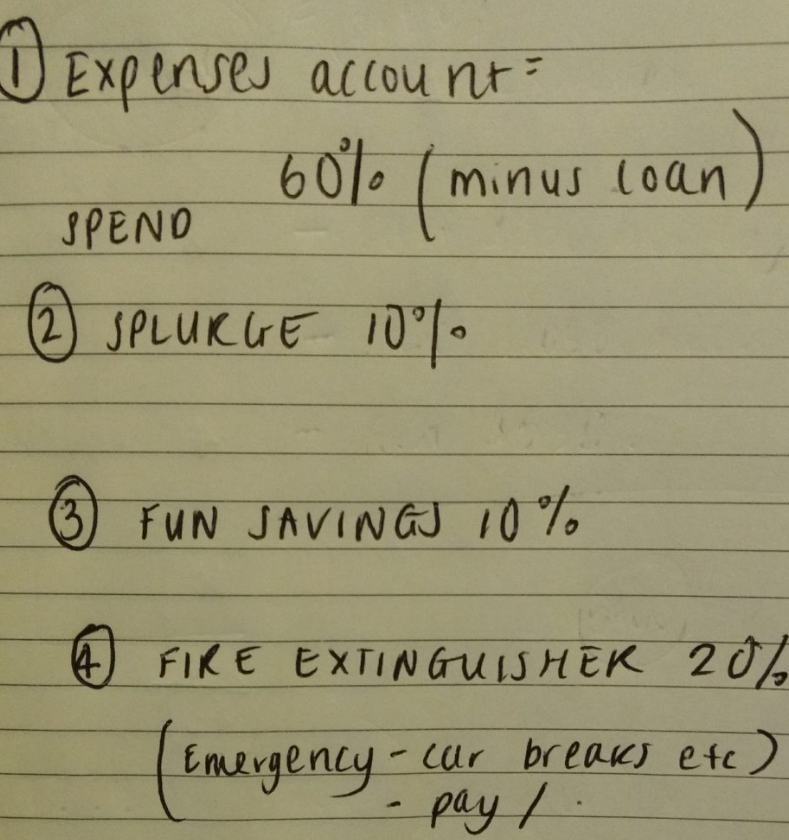

Expenses = 60% of your income

No more than 60% of your income should be allocated to living expenses (food, accommodation bills). If you’re pushing further than this quota then its going to be hard to do anything. Pape recommends to see a financial advisor if you’re in this situation.

Splurge = 10% of your income

This is fun money. For things like pedicures, drinks at the pub or meals out. I’m pretty good at allocating this. (Too good in fact.)

Smile (Fun Savings) = 10% of your income

Fun savings. Things like holidays, home renovations, that new couch that you want. Items that take more than two weeks to save for. This is where I currently spent most of my time spending. (Opps).

Fire Extinguisher = 20% of your income

The fire extinguisher is for short term emergencies. Like your car breaking down or your washing machine dying. You could also use this account to save for something meaningful like investing in shares, or pay down your mortgage a little. But you should also have some for some short term emergencies. This is the account of mine that needs some work.

Somewhere else = MOJO account with 3-4 months of income

This account should be hard to reach, and hard to spend and ONLY touched in a REAL emergency. Like your leg being chopped off or your house burning down. Sitting elsewhere in another institution all together.

So this is what I am trying to implement in my household. Sounds like a lot of accounts right? I kind of like the idea though, as then it is clear what is where without me trying to think about what money is in which account and why. I have not even made it so far to the super and the insurance section. Yikes. I will get there, and I will be in control!

I hope that in six months I will be in control of my finances and all these little pots will grow…grow little money pots!

Do you budget?

Have you read the Barefoot Investor?

What’s your emergency plan?

Ashleigh XXX